Yes, foreigners can buy property in the USA without restrictions, regardless of nationality or immigration status.

Summary: - Foreigners can buy property in the USA regardless of their nationality or immigration status and have the same homeownership rights as US citizens. - There are no additional taxes or restrictions on foreign buyers of US Real Estate. - Purchasing US real estate does not grant immigration status or the right to live in the USA. An immigration document is required to enter the USA. - In addition, HomeAbroad offers mortgage home loan financing to help Newcomers and foreign real estate investors buy property in the USA even with no or thin US credit history. - Moreover, H1B, L1, or F1 visa holders worried about returning to their home country can continue to own US property remotely without any restrictions.

If you’re considering purchasing real estate in a foreign country, it’s completely normal to have numerous questions and feel somewhat daunted by the process. This is particularly true when it comes to a vast and diverse country like the United States, where the procedure may initially appear complex.

Interestingly, many foreigners find the home-buying process in the USA more straightforward than they anticipate. In fact, it’s quite similar for both foreign nationals and US citizens.

Whether you’re relocating to the USA on an H1B or L1 visa, or you’re a foreign real estate investor, purchasing property in the USA is both easy and possible.

With over 14 years of experience in the real estate industry, I have had the unique opportunity to guide many foreign nationals through the intricacies of the home buying and selling process in the United States.

My goal with this guide is to simplify the process of purchasing property in the USA for you as a foreign national, answering common questions and providing clear guidance based on my extensive experience.

Let’s start with the most common concern.

Find a real estate agent with

international expertise

Connect with a real estate agent in your area.

Get Personalized DSCR loan

interest rates.

Get a quote

Get Personalized DSCR loan interest rates.

Get a quote

Get Personalized DSCR loan interest rates.

Get a quote.

Get Personalized DSCR loan interest rates.

Get a quote.

Find a real estate agent with international expertise

Connect with a real estate agent in your area.

Table of Contents

Can a foreigner buy property in the USA?

Yes, of course. Foreign nationals can purchase property in the USA with no restrictions and have the same homeownership rights as US citizens.

You don’t need to be a US citizen to buy property in the USA, and you are free to buy residential or commercial property of your choice. In fact, foreigners have purchased $53.3 billion worth of residential real estate between April 2022 and March 2023. (Source: National Association of Realtors)

51% of these buyers consist of those staying in the USA for less than two years or US newcomers on non-immigrant visas such as an H1B or L1 visa. The remaining 49% constitutes non-resident foreign buyers or foreign real estate investors.

How can foreigners buy property in the USA?

Here’s a step-by-step process on how to buy a property in the United States as a foreign national:

Step 1 – Decide where you want to buy the house in the USA

Whether you are a US newcomer or Expat looking to buy a house near your workplace or school or a foreign real estate investor interested in purchasing an investment property to benefit from US rental yields and property appreciation in US dollars, you’ll be pleased to know that non US citizens can buy real estate anywhere in the USA without restrictions.

Embark on your journey to buy a home in the US today!

Experienced worldwide agents. US mortgage without US credit. Totally free.

Embark on your journey to buy a home in the US today!

Experienced worldwide agents. US mortgage without US credit. Totally free.Pre-qualify for a US mortgage as a foreigner

When looking to buy a new home as a primary residence, it’s important to take into account various factors such as proximity to your workplace, schools, and other amenities. Spend time exploring different neighborhoods and researching the local real estate market to find an area that fits your budget and lifestyle.

Additionally, it’s crucial to understand the commute, school districts, and community vibe of the prospective area. Your real estate agent can provide valuable knowledge of the local market to help you make an informed decision.

Find a Top Real Estate Near you

Begin your journey toward your dream property with the most trusted brand in US.

Embark on your journey to buy a home in the US today!

Experienced worldwide agents. US mortgage without US credit. Totally free.If you are a foreign real estate investor, choosing the right location to invest in can be crucial to achieving your objective rental yield, capitalization rate, and property appreciation. Here are some factors that you can consider to decide where you want to buy your investment property:

- Conduct comprehensive market research to identify areas with strong growth potential and rental demand.

- Take into account factors such as job opportunities, population trends, and economic stability.

- Evaluate the local rental market to ensure that your investment aligns with your financial goals.

Step 2 – Find a real estate agent experienced in international real estate transactions

As an expat or investor, embarking on a journey to find your ideal property in the USA can be a complex adventure. The initial phase of market research is crucial, yet it can be fraught with challenges due to unfamiliarity with the local real estate landscape.

Navigating this terrain solo could lead to expensive pitfalls. That’s precisely why professional insight is invaluable. In the USA, a select group of real estate agents boasts the CIPS (Certified International Property Specialist) designation from NAR (National Association of Realtors), a mark of their commitment to guiding international clients through the intricacies of the US market and the home-buying journey.

What makes CIPS real estate agents stand out for foreign buyers?

- Specialized Training: CIPS agents receive rigorous training tailored to the specific needs of international clientele, ensuring that you have knowledgeable support tailored to your unique situation.

- Multilingual Abilities: With a command of multiple languages, CIPS agents bridge the gap between you and the complexities of local markets and legalities, all while being attuned to your linguistic and cultural preferences.

- Cultural Awareness: They possess a good cultural understanding of their international clientele, which is crucial for effective communication and ensuring that transactions respect the client’s cultural context.

- No Cost to Buyers: It’s an intriguing aspect of the US market – CIPS agents offer their services to buyers without charge, as their commission fees are traditionally covered by the seller.

With a CIPS agent by your side, you’ll gain a clearer perspective on each phase of the purchasing process.

HomeAbroad boasts a vast network of highly qualified CIPS real estate agents, and we can provide you a skilled CIPS agent in desired region. Our agents possess strong local market knowledge, which enables them to assist you in finding the ideal property that meets your unique requirements.

Hear from Rashmi, a nonresident investor who purchased an investment property in Katy, Texas, on how we assisted her.

“Quick response. Reliable and trustworthy. I found HomeAbroad when I was doing my research to buy an investment property in the US. After working with HomeAbroad, I found the perfect real estate agent who helped me purchase an investment property in Katy, TX. The process was smooth and without any problems. I would definitely recommend HomeAbroad to any non-US citizen looking for help purchasing a property in the US.”

Rashmi Mayekar

Purchased Investment Property in Katy, TX. Non-US Resident Buyer.

Step 3 – Working with the real estate agent in the USA

When you engage with a real estate agent knowledgeable about international transactions, they may propose a buyer representation agreement. This mutual contract defines the relationship between you and the agent, setting out respective duties and responsibilities, as well as the duration of the agreement. Carefully review and understand this document before signing to ensure you’re aware of all stipulations.

While it’s a common practice for the seller to cover the commission costs in the USA, it’s not an absolute rule. Make sure to verify any potential fees or commissions for which you may be responsible—these details should be explicitly stated in your agreement.

Keep in mind that the use of a buyer representation agreement can vary with each agent. Some may not require one, highlighting the importance of discussing and understanding the terms of your collaboration with your chosen agent from the outset.

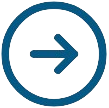

Step 4 – Navigating your US real estate tax obligations as a foreign national

If you plan to buy a property in the USA, it’s important to understand the real estate tax implications based on your intended use, whether it’s for personal use (primary residence/second home) or investment purposes. As a foreign buyer, you won’t be subject to additional real estate taxes in the USA.

For All Foreign National Property Buyers:

- Property Tax: Regardless of your intended use, all property owners in the USA must pay property tax, including foreign nationals. As a foreign national, your property tax rates will be the same as those for US citizens.

For Investment Property Owners:

- Income Tax: Income generated from property, such as rental earnings, is taxed at the same rate as for US citizens.

- Capital Gains: No taxes are levied on the property’s appreciation until it is sold. However, specifics apply when you sell:

FIRTPA Considerations: Under FIRTPA (Foreign Investment in Real Property Tax Act), when a non-resident foreigner sells US real estate, a portion of the sale proceeds (usually 10%-15%) must be withheld by the buyer at closing and remitted to the IRS. This isn’t an additional tax but a prepayment towards any potential capital gains tax liability. Foreign buyers will be entitled to a refund based on the actual capital gain tax rate (same as US citizens) when they file their tax returns.

Special Notes for Non-Resident Foreign Nationals:

- FIRTPA Exemptions: Foreign nationals with a legal US residency, such as H1B visa holders, are not subject to FIRTPA withholding.

- Tax Identification Requirements: If you lack a Social Security Number (SSN), you’ll need to obtain an Individual Taxpayer Identification Number (ITIN) to file US tax returns. An ITIN serves as a tax processing number for those ineligible for an SSN, ensuring compliance with US tax laws.

As tax regulations can be intricate and subject to change, consulting with a tax professional is recommended for personalized guidance. Always refer to the latest IRS guidelines to stay informed on current requirements and procedures.

Step 5 – Mortgage financing options for foreign nationals and expats

Most of the foreign real estate buyers I’ve come across were initially unaware that they could even qualify for a US mortgage, especially due to a lack of US credit history.

On the contrary, the US property market is inclusive, offering a spectrum of financing avenues to support the aspirations of foreign nationals – expats with established credit, US newcomers, and foreign real estate investors.

Expats with a US credit history can find mortgage options similar to those available to citizens, especially when partnering with lenders who are well-versed in non-citizen residential statuses, including those on work visas and green card holders.

For newcomers to the USA with limited or no credit history, some lenders provide mortgage programs that do not require a US credit history. Instead, they consider credit reports from the borrower’s home country.

This approach can provide a solid foundation for obtaining financing without the delay of establishing a new domestic credit profile, helping newcomers to get to homeownership faster.

Foreign real estate investors have additional specialized options. A full documentation loan would require thorough financial disclosures and credit evaluation, possibly including international credit checks.

Meanwhile, the DSCR loan caters specifically to investment properties, determining eligibility based on the rental income generated versus the mortgage and operational expenses. This can be particularly advantageous for investors who prefer to leverage the property’s financial performance over personal income verification.

Before proceeding with a purchase, all foreign buyers should assess these varied financing methods.

HomeAbroad offers suitable foreign national mortgages to help expats, newcomers, and non-resident investors buy a primary residence or investment property in the USA.

Don’t take our word for it. Steve, an H1B visa holder who purchased a house in Charlotte, NC, shares how we assisted him.

“HomeAbroad is the perfect solution for anyone who is moving to the United States and looking to buy a house. I didn’t even know that I can get mortgage financing to buy a house. It was really a game-changer for me. I couldn’t have been happier with their assistance in finding an agent who understood my specific situation and helped me get my mortgage approved with a lender.”

Steve Papadakis

Purchased Primary Residence in Charlotte, NC. US Newcomer on H1-B Visa.

Step 6 – Embark on your property search

Begin your property search by detailing your preferences to a Certified International Property Specialist (CIPS) agent. They will streamline your search by curating a list of properties that match your criteria and presenting them to you, leveraging the power of online resources.

If you’re new to the USA or an expat, your agent will facilitate property tours during open houses. For foreign real estate investors not yet in the country they can provide a virtual tour experience, offering a comprehensive view through photos and videos, enabling you to make informed decisions from afar.

Leverage your agent’s expertise to inquire about property features and inclusions. Typically, in the USA, kitchen cabinets and appliances are part of the sale, and the land ownership is transferred with the property.

When considering financing, contact a mortgage lender early to secure a pre-approval. This process evaluates your financial standing and provides an estimate of the loan amount you’re eligible for.

Craft a budget reflecting the financing available to you. Collaborate with your agent to comprehend all related homebuying expenses, such as closing and financing costs, along with the earnest money requirements.

This ensures you’re financially prepared for the down payment and subsequent costs associated with securing the property you desire.

Step 7 – Making an offer on a chosen property

After pinpointing the property you wish to call your own, your agent will perform a comparative market analysis, presenting data on recently sold properties in the vicinity. This insight is crucial in crafting a competitive and realistic offer that aligns with market trends.

When your offer is submitted, anticipate one of three responses from the seller:

- Acceptance: If the seller agrees to your terms, celebrate the moment; your American dream of property ownership is within reach.

- Rejection: A declined offer is not the end. It’s an opportunity to reassess and strategize further with your agent.

- Counteroffer: A counterproposal initiates a negotiation phase, where you’ll consider whether to meet the new terms or hold firm.

Embrace this phase of the journey with patience and preparedness. Should the seller accept your offer, the process transitions into a phase of due diligence and finalizing details for closing. Your agent will guide you through these subsequent steps, ensuring you’re well-informed and ready to proceed.

Step 8 – Finalizing your commitment: The purchase contract

After your offer is accepted, you’ll proceed to solidify the agreement by signing a contract of sale with the seller. This legally binding document encompasses the agreed-upon price and terms, such as the closing date and any contingencies, which your agent has negotiated on your behalf.

At this juncture, it’s standard to secure the transaction with an earnest money deposit. Typically, this is about 1%-3% of the home’s purchase price, though it can vary based on local customs and market conditions. The funds are placed in an escrow account, managed by an impartial third party, to be held until the transaction is complete.

This earnest money signifies your genuine intention to purchase and follow through with the contract. It’s crucial to understand that depending on the terms of your agreement, this deposit may be at risk if you decide to withdraw from the deal without a contractual basis for doing so.

If you are financing your new house, it’s time to reach out to your mortgage lender and provide them with your signed purchase contract to start the mortgage process.

Step 9 – Securing peace of mind: The title report

Before you finalize your property purchase, a title report is an essential step to ensure you’re making a secure investment. This report, crafted by a title company or attorney, delves into the property’s history, detailing past ownership, legal claims, and any potential encumbrances that could affect your rights as a future owner.

Through a meticulous examination of public records, the title experts compile a history of the property, identifying any outstanding liens, easements, or other legal obligations.

This comprehensive review assures you that the property you are about to purchase has a clear title, free of undisclosed heirs, disputes over property boundaries, or prior unsettled debts.

The significance of the title report cannot be overstated—it is your shield against future legal complications. It ensures that any financial claims, like unpaid property taxes or creditors’ liens, are resolved by the seller before you proceed to closing.

Moreover, it confirms that there are no restrictions or allowances on the property that could hinder your enjoyment or use.

Understanding and obtaining a thorough title report not only provides legal security but also peace of mind as you step into the role of a homeowner.

Step 10 – Thorough home inspection and due diligence

With the assurance of a clear title and the confidence that comes with legal security, the next prudent step in safeguarding your investment is to focus on the physical condition of the property. This leads us to a critical juncture in the home-buying process: the home inspection.

While the concept of a home inspection may vary internationally, in the USA, it is a comprehensive evaluation of a property’s condition conducted by a certified professional.

Opting out of a home inspection could lead to unforeseen complications, especially in older homes where issues are not always visible. Inspections can uncover structural problems, electrical issues, plumbing malfunctions, and more, which are vital to identify before finalizing your investment.

For foreign buyers, it’s important to note that the inspection can serve as a negotiation tool. If the inspector identifies any defects, it’s a standard practice to either request the seller to make repairs or to negotiate a price adjustment to account for the potential costs you will incur.

Your agent can facilitate this process, drawing on their knowledge of local real estate norms to advocate on your behalf.

A final walk-through, conducted after repairs and just before closing, is your opportunity to ensure that all conditions have been met satisfactorily. It’s a procedural step that allows you to verify that the property is in the agreed-upon state before you assume ownership.

Incorporating an inspection contingency within your purchase agreement provides a layer of protection, enabling you to rescind the offer without forfeiting your earnest money should significant issues be discovered.

Understanding and utilizing these steps will safeguard your purchase, ensuring that the property you’ve chosen meets both your expectations and the rigorous standards of US real estate practices.

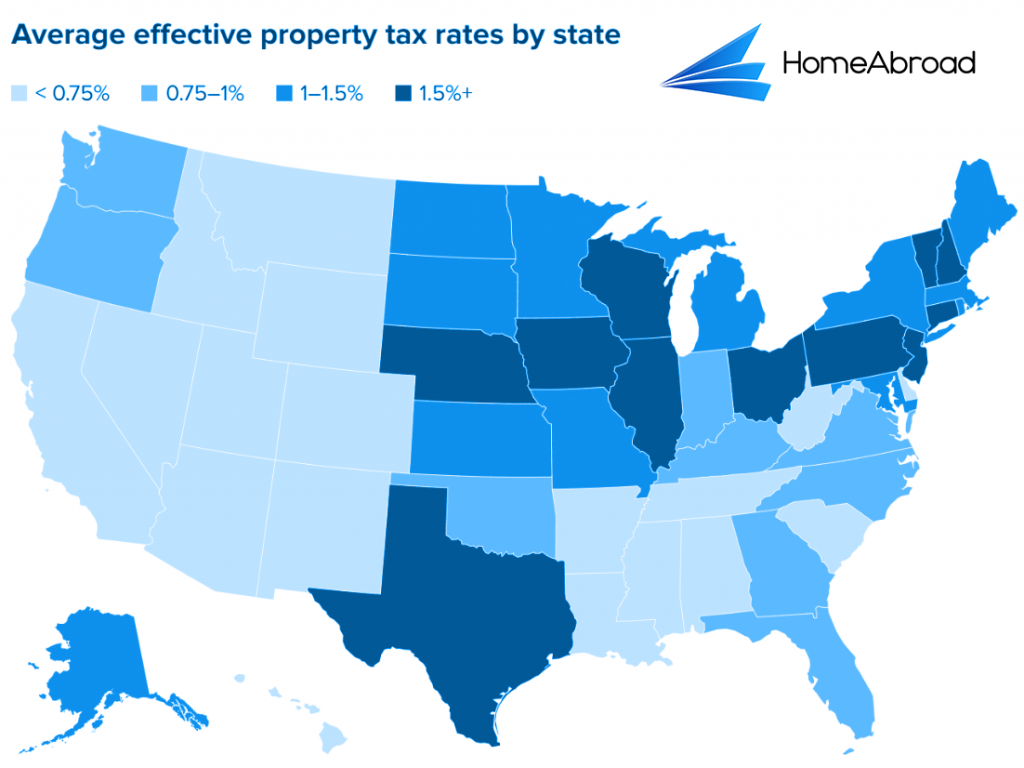

Step 11 – Finalizing your home purchase in the USA

Post-final walk-through, assuming all is as you’ve expected, the next stage is the transfer of ownership. Prior to closing, if you’re financing your property, double-check with your lender to ensure that your mortgage has been finalized and is set for the designated closing date.

A critical step is reviewing the closing disclosure provided by your lender, typically received three days before closing. This document is key, detailing your loan’s terms, closing costs, and ongoing financial commitments.

At the closing, armed with identification, proof of funds, and the closing disclosure, you’ll convene with the necessary parties. The essence of closing is consistent: the signing of the deed, which is the document that transfers property ownership to you. After your signature, the closing agent notarizes and records the deed at the local government office, finalizing the legal transfer.

When it comes to handling closing costs and down payments, follow the instructions of your closing company to ensure a smooth transition.

For non-resident foreign buyers who are unable to be present in the United States for closing, there are established methods to ensure the process can be completed from abroad. These buyers can engage in the closing process via the following means:

- Embassy or Consulate Services: Many countries’ embassies and consulates in the buyer’s home country offer notary services that are recognized in the United States. Buyers can sign documents in the presence of a consular officer.

- Apostille Certification: For countries that are members of the Hague Apostille Convention, documents such as a power of attorney can be certified with an apostille. This certifies the authenticity of the document for international use.

- Power of Attorney (POA): Buyers can grant a power of attorney to a trusted individual who is in the US, such as their real estate agent or an attorney, to sign documents on their behalf. It’s essential to ensure that the POA is drafted according to the laws of the state where the property is being purchased and is properly notarized and, if necessary, apostilled.

Each of these methods requires careful preparation and adherence to specific legal requirements. It is advised that foreign buyers work closely with their real estate agent, mortgage lender, and legal counsel to coordinate the necessary steps.

This may involve arranging for documents to be sent internationally, ensuring all necessary signatures are obtained, and verifying that documents are returned in a timely manner to complete the transaction.

Remember, while the process can be conducted from abroad, it is imperative to have clear and open communication with your real estate professionals throughout this critical phase to ensure everything is executed correctly.

With these measures in place, foreign buyers can confidently close on a property, transcending geographic barriers to secure their investment in the US real estate market.

Congratulations on reaching this significant milestone and becoming a homeowner in the United States!

Throughout the process, you must have noticed that CIPS agents make everything a lot easier at every stage. Let HomeAbroad get you in touch with one of these agents through our wide network. We can help you connect with an agent in your desired area, who will hand-hold you through the process of buying the perfect property.

What documents are required by foreigners buying property in the USA?

When purchasing property in cash, it’s essential to provide proof of funds, demonstrating you have the necessary liquid assets to cover the purchase price and any associated tax obligations.

On the other hand, if you opt for financing, the required documentation will vary based on your chosen loan program. This often includes demonstrating your ability to repay the loan.

For a detailed breakdown of the documents needed to secure a mortgage without a US credit history, refer to this foreign national mortgage guide.

Who are the top 5 foreign US real estate buyers in 2023?

According to National Association of Realtors, China has emerged as the number one country of origin for acquiring property among foreign buyers from April 2022 to March 2023, accounting for 13% of all transactions. The second-largest country of origin for foreign buyers was Mexico, at 11%. The third-largest country of origin was Canada, with 10%. India is 4th biggest real estate buyer in the USA with 7%, closely followed by Columbia in fifth position with a 3% share.

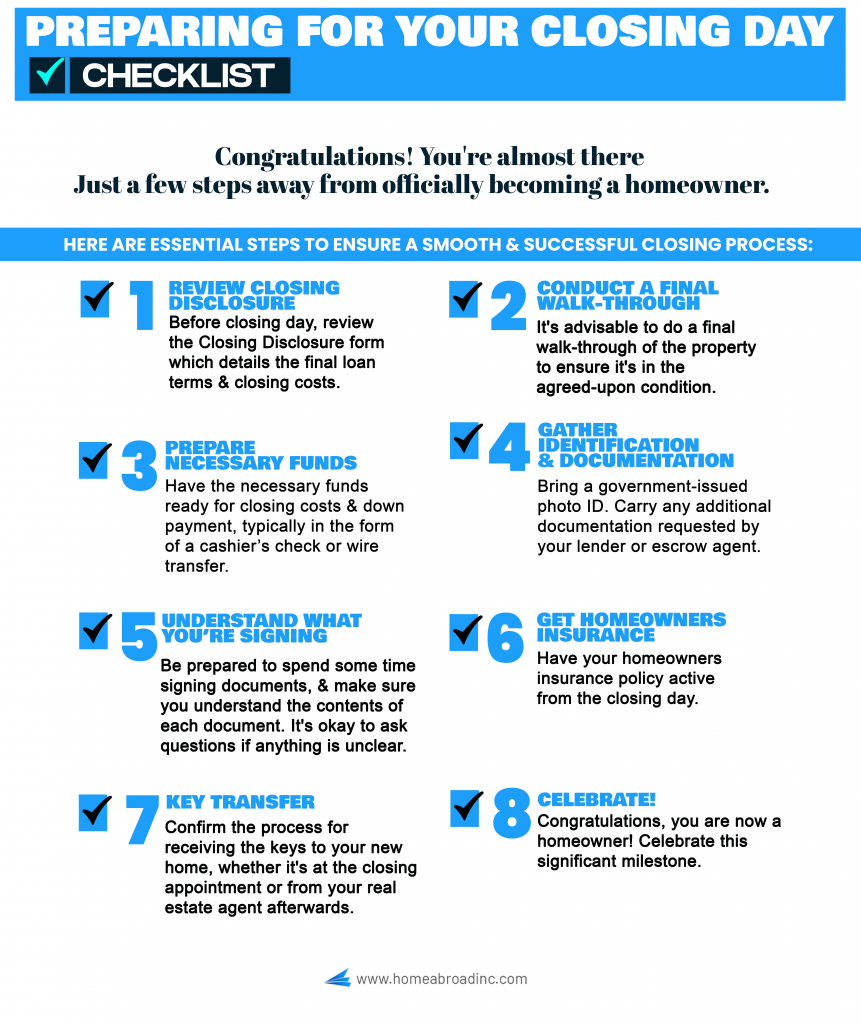

1. China

From 2010-2023, Chinese real estate buyers of US property bought an average of $16.64 billion per year worth of US real estate, with an average of 24,207 units bought per year. This makes the Chinese (including buyers from the People’s Republic of China, Hong Kong, and Taiwan) the largest group of foreign real estate investors in the USA.

Top US destinations for foreign buyers from China in 2023:

- California (33%)

- Florida (16%)

- Texas (8%)

- Colorado (6%)

- New York (6%)

In 2023 (Apr’22-Mar’23), Chinese buyers’ median and the average purchase price were $723,200 and $1,234,500, respectively.

Most Chinese buyers purchased a property in the USA for use as a primary residence (38%), followed by vacation and rental (30%), vacation home (13%), and student use (8%).

67%% of Chinese buy Detached Single-family, followed by Townhouses and Condominiums at 16% and 11%, respectively.

For more detailed insights into the trends and process of Chinese nationals buying property in the USA, be sure to read our comprehensive guide.

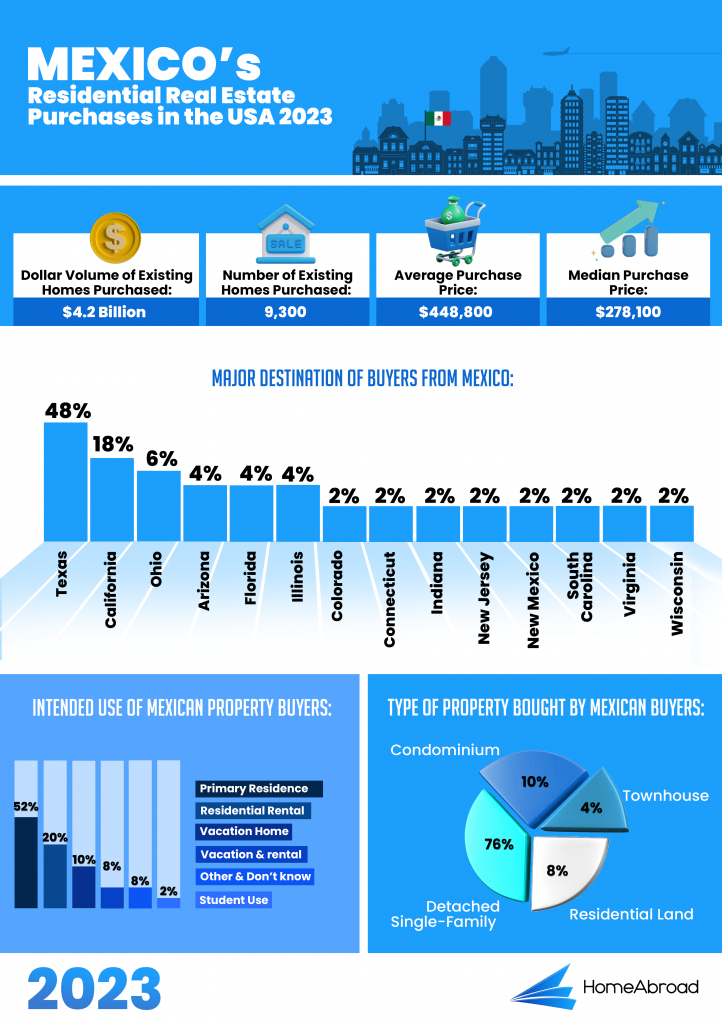

2. Mexico

From 2010-2023, Mexican real estate buyers of US property have bought an average of $4.26 billion per year worth of US real estate, with an average of 15,842 units bought per year.

Top US destinations for foreign buyers from Mexico in 2023:

- Texas (48%)

- California (18%)

- Ohio (6%)

- Arizona (4%)

- Florida (4%)

In 2023 (Apr’22-Mar’23), Mexican buyers’ median and the average purchase price were $278,100 and $448,800, respectively.

53% of buyers from Mexico purchased a property in the USA for use as a primary residence, while 20% for residential rental, 10% for vacation home, and 8% for vacation and rental.

76% of Mexicans buy Detached Single-family, followed by Condominium and Residential Land at 10% and 8%, respectively.

For more detailed insights into the trends and process of Mexicans buying property in the USA, be sure to read our comprehensive guide.

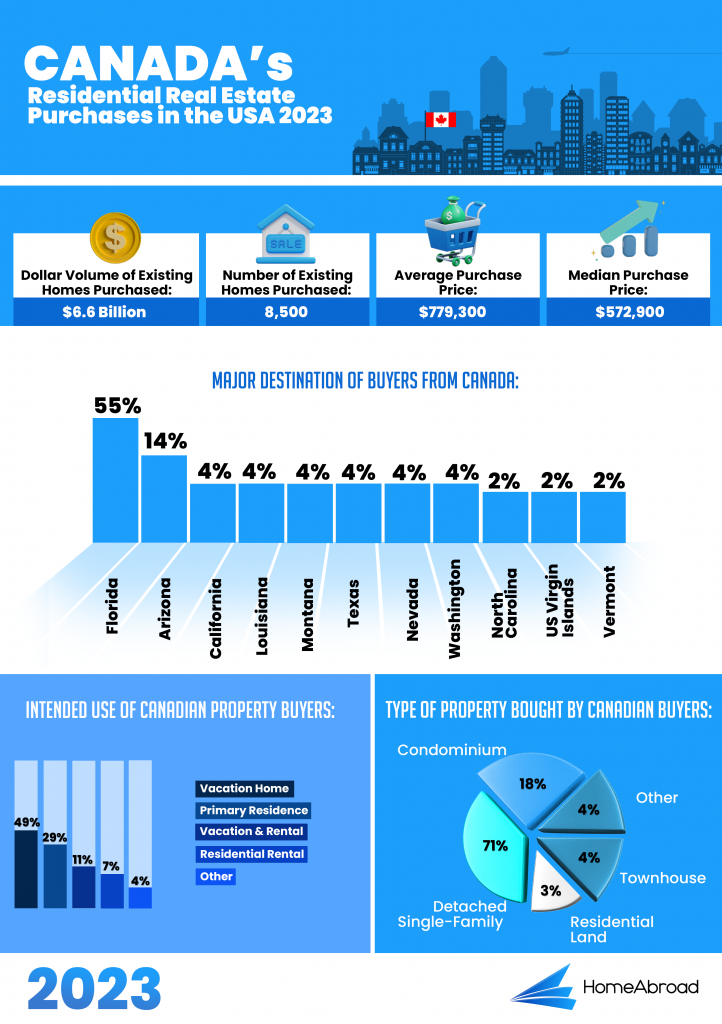

3. Canada

From 2010-2023, Canadian real estate buyers of US property have bought an average of $10.91 billion per year worth of US real estate, with an average of 31,357 units bought per year.

Top US destinations for foreign buyers from Canada in 2023:

- Florida (55%)

- Arizona (14%)

- California (4%)

- Louisiana (4%)

- Montana (4%)

In 2023 (Apr’22-Mar’23), Canadian buyers’ median and the average purchase price were $572,900 and $779,300, respectively.

49% of buyers from Canada purchased a property in the USA for use as a vacation home, while 29% for primary residence, 11% for vacation and rental, and 7% for residential rental.

71% of Canadians buy Detached Single-family, followed by Condominiums and Townhouses at 18% and 4%, respectively.

For more detailed insights into the trends and process of Canadians buying property in the USA, be sure to read our comprehensive guide.

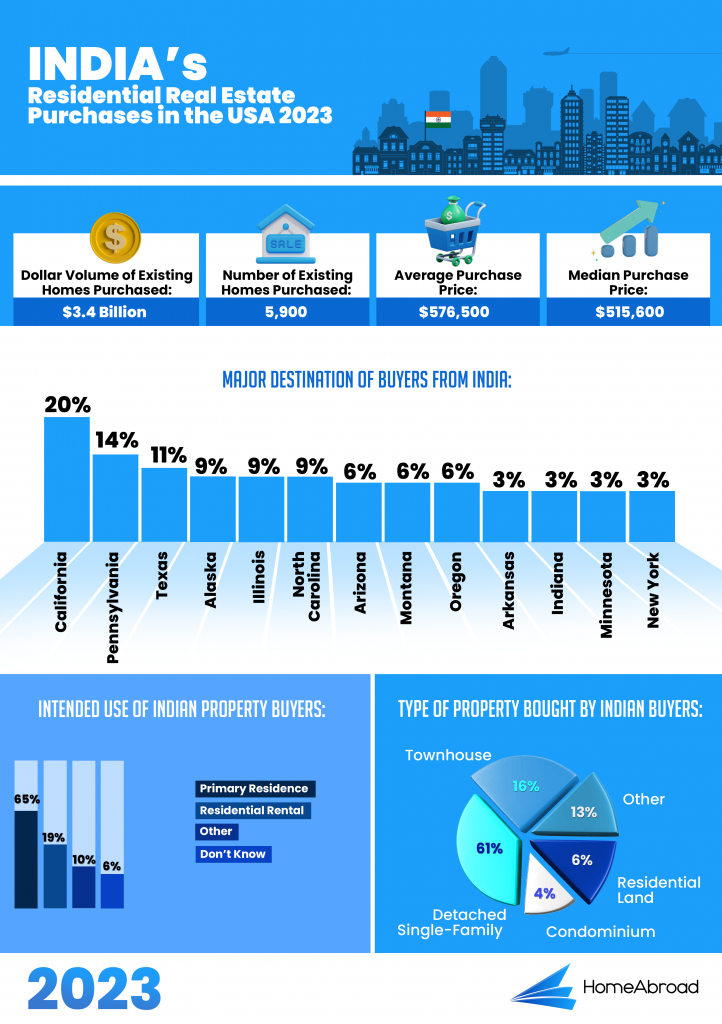

4. India

From 2010-2023, Indian real estate buyers of US property have bought on average $5.27 billion per year worth of US real estate with an average of 11,428 units bought per year. The majority of US property buyers from India are US resident buyers (~90%).

Top US destinations for foreign buyers from India in 2023:

- California (20%)

- Pennsylvania (14%)

- Texas (9%)

- Alaska (9%)

- Illinois (9%)

In 2023 (Apr’22-Mar’23), the median and average purchase price for Indian buyers was $515,600 and $576,500, respectively.

65% of buyers from India purchased a property in the USA as a primary residence, followed by residential rental at 19%.

61% of Indians buy Detached Single-family, followed by Townhouses and Residential Land at 16% and 6%, respectively.

For more detailed insights into the trends and process of Indians buying property in the USA, be sure to read our comprehensive guide.

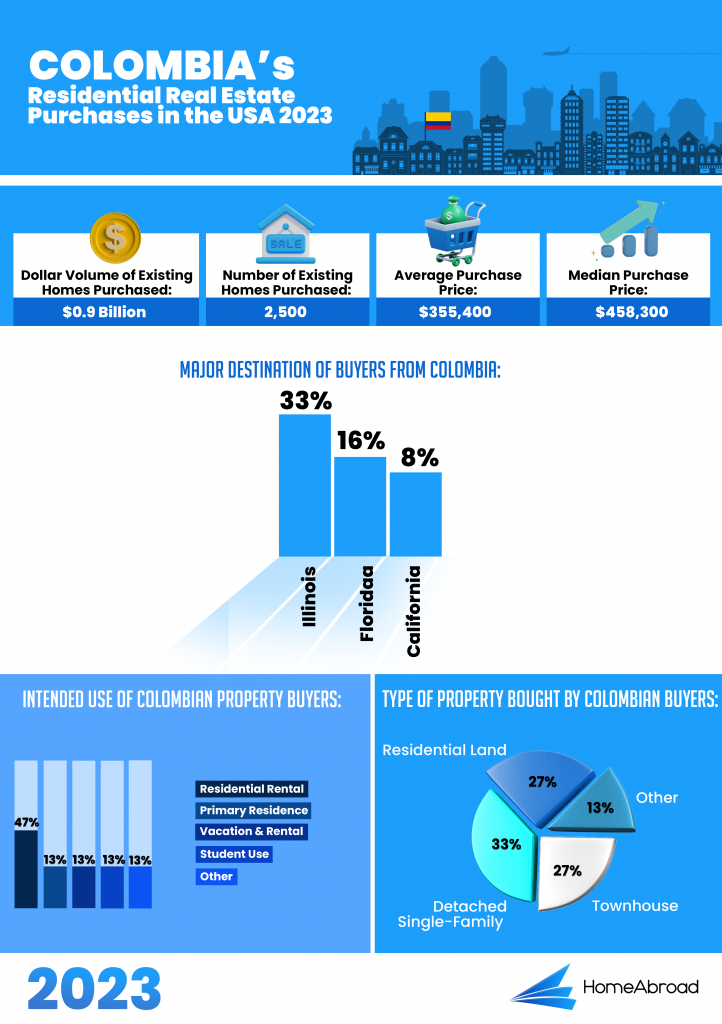

5. Colombia

From 2010-2023, Colombian real estate buyers of US property have bought, on average, $1.57 billion per year worth of US real estate, with an average of 2,857 units bought per year.

Top US destinations for foreign buyers from India in 2023:

- Florida (80%)

- California (13%)

- Illinois (7%)

In 2023 (Apr’22-Mar’23), the median and average purchase price for Colombian buyers was $458,300 and $355,400, respectively.

47% of buyers from Colombia purchased a property in the USA as a residential rental, followed by primary residence (13%), vacation and rental (13%), and student use (13%).

33% of Colombians buy Detached Single-family, followed by Townhouses and Residential Land at 27% each.

To sum up, buying a property in the USA as a foreign national is straightforward and similar to the process for US citizens. You just need the right help, like real estate agents with CIPS designation who understand foreign buyers and mortgage lenders who work with foreign nationals with no US credit.

Just follow the steps we’ve outlined, and you’ll be on your way to owning a US property. At HomeAbroad, we make it easy for you. We’ll connect you with a CIPS agent and a mortgage lender to start your property-buying journey and ensure the smoothest completion.

Frequently Asked Questions (FAQs)

-

How can a foreigner buy investment property in the USA?

The process for purchasing an investment property in the USA follows the same steps outlined in this guide. If you’re an investor looking to buy property remotely in the USA, connecting with a CIPS agent is your best move. They can provide all the support and guidance you need to buy property in the USA remotely.

-

Can I get a green card or residency if I buy a property in the USA?

No, you can’t get a green card or any immigration benefits by buying a house in the USA. However, there are no restrictions for non-US citizens to purchase a property anywhere in the USA.

-

Are foreign investors required to pay property tax in the US?

Yes, foreign investors who buy US property must pay property tax on their foreign investment, similar to a US citizen. Apart from property tax, foreign nationals must abide by capital gain tax if they sell the property.

-

Can foreigners buy land in the USA?

Yes, foreigners can buy land in the USA, but you need to comply with the state’s property laws to buy the land.

-

How long does buying a house in the USA take?

For cash buyers, expect ownership in about 30 days from the contract signing. If financing with a mortgage, anticipate ownership in around 30-60 days from contract signing, depending upon your state.

-

Are house prices cheap in the USA?

Home prices in many US metro areas are comparatively low compared to prices in the central area of global cities. For example, even in a relatively costlier US city like San Francisco, per square meter of residential real estate costs $8,250 compared to $26,262 in London (UK), $28,570 in Hong Kong (China), $10,947 in Toronto (Canada), $10,932 in Mumbai (India), etc. (Source: National Association of Realtors)

-

What are the rules for foreigners buying property in the USA?

There are no specific additional rules for foreigners buying property in the USA. The process and implications of purchasing real estate are essentially the same for both foreigners and US citizens.

-

Can I buy a house in the USA with a tourist visa?

Yes, you can buy a house in the USA while on a tourist visa. If you are a non-resident investor purchasing investment property, it is entirely feasible to close on your property using a tourist visa. However, it’s important to remember that buying property in the USA does not grant you the right to stay in the country longer than your visa allows, nor does it provide you with residency status.

-

Who can buy a house in the USA?

Anyone can buy a house in the USA, regardless of citizenship and residency status in the USA.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

- Board of Governors of the Federal Reserve System. “Report on the Economic Well-Being of U.S. Households in 2022-May 2023.”

- Investopedia. “Average Credit Card Interest Rates – Dec. 2023: Rates Rise Again.”

- Federal Trade Commission. “Home Equity Loans and Credit Lines.”

- Federal Reserve Bank of St. Louis. “Personal Saving Rate (PSAVERT).”

"Unlocking US real estate for the world with our tailored offerings."

How Does HomeAbroad Help?

Case Studies

Yes, foreigners can buy property in the USA without restrictions, regardless of nationality or immigration status.

Yes, foreigners can buy property in the USA without restrictions, regardless of nationality or immigration status.