Are you wondering if now is the right time to buy property in Arizona? According to the latest statistics, it surely is! In recent years, the number of real estate owned by Canadians has increased steadily. In fact, Canada is one the largest foreign investor in U.S. real estate, with a substantial investment totaling $5.5 billion. Among these investors, 23% have chosen to purchase property in the Sunset State of Arizona.

This article will guide you through the home-buying process in Arizona. We’ll cover topics such as mortgage options for Canadians, the home-buying process, taxation, and how to find a trustworthy real estate agent and mortgage lender in Arizona.

Table of Contents

Can a Canadian Buy Property in Arizona?

Absolutely Yes! Arizona is one of the most popular destinations amongst Canadians when it comes to buying a secondary home in the USA. According to the NAR,

- 58% of Canadians buy homes in the US for vacation purposes

- 11% of Canadians invest in residential rentals

- 16% buy primary residences

If you, too, are looking for a vacation home, rental property, or primary residence, HomeAbroad can pair you up with trained CIPS real estate agents who can help you find a property that meets your pocket as well as your real estate investment goals.

Download GuideCan Canadians Get a Mortgage in Arizona?

Yes, you can get a mortgage in Arizona to finance property purchases. The mortgage system in America caters to the following categories of loan applicants:

- Canadians with a US credit history

- Canadians without a US credit history

Irrespective of your category, we help you connect with mortgage lenders. Our extensive network of experienced lenders and technology-driven platform come together to guide you through the US- home buying process, ensuring a seamless experience to realize your dream of homeownership.

Let’s explore more about the mortgage options in our next section.

Explore Mortgage Options for Canadians Buying Property in Arizona

When looking to buy a property in AZ, there are many different mortgage options available to you. Many lenders offer specifically tailored mortgage options for Canadian borrowers, taking into account their unique financial needs and requirements. It is important for you to research all of the options available before making a decision.

Mortgages with an Established US Credit History

Canadians with a strong US credit history can access Qualified Mortgages. You should have an established credit history, demonstrating your trustworthiness in financial management and meeting obligations.

1. Conventional Loans

Conventional mortgages are provided by banks and lenders to eligible Canadian buyers. They can be obtained from banks, credit unions, and other lenders. Most lenders prefer applicants with at least two years of previous employment in the US. These mortgages are backed by entities like Fannie Mae and Freddie Mac, offering borrowers the benefits of low down payment.

Qualifications:

- A down payment of 3-20% is necessary. However, PMI is typically required when making a down payment of less than 20%.

- A credit score of 620 or higher

- 2 years of tax returns

- Social Security Number (SSN) (Canadians who do not qualify for an SSN can apply for an ITIN using IRS Form W-7.)

- To demonstrate a stable job history spanning at least 2 years, you may provide supporting documents such as an Employment Verification Letter, bank statements, work visa, credit report, or tax returns.

2. Federal Housing Administration (FHA) Loan

Canadians with established US credit may be eligible for FHA loans. These loans have a lower down payment, and you need an established US credit history and proof of income. Also, a valid visa and Employment Authorization Document are required.

Note that FHA loans require mortgage insurance premiums (MIP), increasing monthly housing costs. The upfront MIP for FHA loans is 1.75 percent of the loan amount, while the annual MIP varies based on the loan’s size, term, and loan-to-value (LTV) ratio. However, they are more lenient in terms of credit requirements compared to conventional loans.

Also Read: How to Get an FHA Loan For Investment Property?

Qualifications:

- 3.5% down payment

- A credit score of 580 or higher

- A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- A stable job or employment history in the U.S. of at least two years.

- A lower debt-to-income ratio not exceeding 43%

Mortgages with no/thin US Credit History

For Canadians with no or thin US credit history, non-traditional loan options are available. These mortgage programs help fellow Canadians who may lack a US credit history, who want to avoid the paperwork of FHA and conventional loans, or who have irregular income.

1. Foreign National Mortgage

Foreign national loans are customized for foreign buyers looking to purchase a primary residence in the USA. This loan program is for international clients who lack US credit to get a mortgage in the US. With this loan program, Canadians can get mortgages with no or thin US credit history.

Qualifications:

- A down payment of 20% or higher

- A Debt-to-Income ratio of 43% or lower

- Credit reports from home country

- Valid visa and proof of residency

- Students can use their parents’ income or get a co-signer

2. DSCR Mortgage

DSCR Loan for Canadians is designed to assist you in purchasing investment properties. Lenders evaluate the borrower’s ability to meet debt obligations by calculating DSCR. A high DSCR indicates a greater likelihood of loan repayment. A credit score of 620 or higher is typically required for a DSCR loan. However, as a Canadian, you can secure a mortgage with a no/thin US credit by demonstrating creditworthiness through your home country’s credit report.

Qualifications:

- A DSCR ratio of 1 or higher

- Down Payment of 20-25%

- Property appraisal and 1007 Rent Schedule

- A maximum LTV ratio of 80% is required

Connect with a DSCR Loan Lender

Submit your details to get a quote!

How Can Canadians Buy Property in Arizona?

You can buy property in Arizona by following these steps and considering the necessary requirements:

1. Determine Your Purpose and Budget

- Are you in the market for a vacation retreat, an investment property, a cozy retirement haven, or a new place to call home? By clarifying your objectives, you can simplify and direct your search, increasing your chances of finding the ideal property.

- Craft a comprehensive budget that takes into account all pertinent expenses. Factor in the property’s purchase price, closing costs, property taxes, homeowners’ insurance, ongoing maintenance, and any other potential outlays. This way, you’ll have a clear picture of the financial considerations involved in your property journey.

2. Find the Best Lender

- When it comes to acquiring the property, you have a couple of avenues to explore. You can opt for an all-cash purchase, which means buying it outright, or you can delve into mortgage financing possibilities. To navigate this path smoothly, it’s a good idea to get in touch with U.S. lenders who specialize in international transactions or Canadian lenders who offer cross-border financing options.

- HomeAbroad specializes in connecting foreign national clients with experienced lenders. Whether you have a strong US credit history or no/thin US credit history, they can provide tailored mortgage solutions to meet your needs.

3. Choose the Right Location

- Explore the diverse cities and regions of Arizona to uncover the ideal location that aligns with your personal preferences. Take into account various factors, including the climate, available amenities, proximity to job prospects, and the lifestyle you envision.

- When it comes to securing a real estate agent, it’s vital to choose someone well-versed in international transactions. HomeAbroad can be your invaluable resource here, linking you with Certified International Property Specialists (CIPS) agents who possess expertise in global real estate dealings – and the best part is, this service is free!

These seasoned agents can guide you every step of the way in your home-buying journey and provide valuable assistance in identifying suitable properties.

4. Mortgage Pre-Approval

- For a seamless financing experience, it’s a wise move to secure mortgage pre-approval. This step not only assists you in setting a clear budget but also solidifies your position as a serious and dedicated buyer.

- When it’s time to finance your property purchase, make sure to complete a mortgage application with your chosen lender. Once approved, you’ll receive a pre-approval letter detailing the loan amount for which you qualify. This document adds significant weight to your offer when you’re ready to submit a bid.

5. Apply for a mortgage

- To ensure a seamless financing process, it’s essential to understand the requirements of your lender and take the first step by initiating the mortgage application. Collaborate with U.S. mortgage lenders who specialize in cross-border transactions, leveraging their expertise for a smooth international property purchase.

- To strengthen your mortgage application, it’s crucial to assemble vital financial documents. These typically include proof of income, bank statements, and a comprehensive employment history. This meticulous preparation ensures that your application is in top shape, increasing your chances of obtaining the financing you need.

6. Property Inspection

- Arrange for professional property inspections, which should encompass a comprehensive assessment of the home, including a termite inspection. The results of these inspections can reveal any potential issues or necessary repairs that may influence your decision-making process or provide you with valuable negotiation leverage.

7. Title Insurance

- Perform a thorough title search to verify the absence of any unresolved liens, claims, or title disputes associated with the property.

- Invest in title insurance to safeguard your valuable investment. This policy provides financial protection in case of unforeseen title complications, ensuring peace of mind and security.

8. Underwriting

- Once you’ve applied for a mortgage, the lender will begin underwriting. This includes a thorough evaluation of your financial and credit information.

- Underwriting evaluates your loan repayment capability and ensures you meet the lender’s criteria. It involves a property appraisal and a thorough review of your financial history.

- Provide additional documentation and respond to any requests from the lender during the process.

9. Closing Process

- This typically entails signing essential legal documents, transferring funds, and finalizing the sale.

By carefully following these detailed steps and getting expert advice, you can skillfully navigate the process of buying property in AZ.

5 Best Places to Buy a House in Arizona for Canadians

Arizona is one of the most desirable places for a Canadian buyer to invest in property, with many benefits that make it an attractive option. Below are the best places for you to buy property:

1. Scottsdale

- Scottsdale is known for its upscale lifestyle and offers many housing options, from luxury estates to condos.

- Average Home Price: $776,383

- Median Rent: $2,927 per month

2. Phoenix

- Phoenix, the capital and largest city in Arizona, provides diverse real estate opportunities.

- Average Home Price: $415,258

- Median Rent: $2,020 per month

3. Tucson

- Tucson is known for its affordable real estate, making it an excellent choice for buyers from Canada looking for budget-friendly homes.

- Average Home Price: $323,885

- Median Rent: $1,523 per month

4. Sedona

- Real estate in Sedona includes luxury properties with breathtaking views and cozy cabins tucked into the mountains.

- Average Home Value: $896,078

- Median Rent: $3,057 per month

5. Flagstaff

- Flagstaff’s charming downtown area features historic homes, while newer developments offer modern amenities. The city is an excellent choice for those who appreciate four seasons and proximity to the Grand Canyon.

- Average Home Price: $631,199

- Median Rent: $2,545 per month

Finding Mortgage Lenders for Canadians in Arizona

When purchasing property in the US, it is crucial for you to find suitable mortgage lenders. It is important to seek out lenders who specialize in cross-border transactions and have extensive experience working with Canadian buyers. These lenders understand your unique challenges and the requirements involved.

HomeAbroad specializes in connecting foreign nationals with experienced lenders who are well-versed in working with international buyers. Whether you have no or thin US credit history, they can provide a mortgage. You can rest assured that they will assist you in securing the right mortgage for your situation.

Connect with a Special Real Estate Agent for International Buyers

Having a local expert to navigate you through the market situation and home-buying process could be a great help, especially when you are not a citizen of the country. Certified international property specialist (CIPS) agents are real estate agents trained to work with international expertise.

The good thing is, in the US, the seller pays the buyer’s agent, so you can get expert help for free!

So, why not get an expert buyer’s representation?

HomeAbroad has a network of CIPS agents, and we can connect you with the one to get you started with your property search and buying process.

Latest Arizona Real Estate Market Report

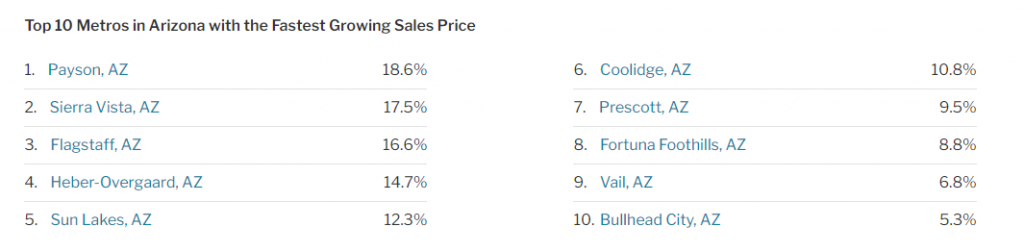

The real estate market in Arizona presents enticing investment opportunities for Canadian buyers. With increasing property prices and a wide range of options to choose from, now is the perfect moment to enter the market.

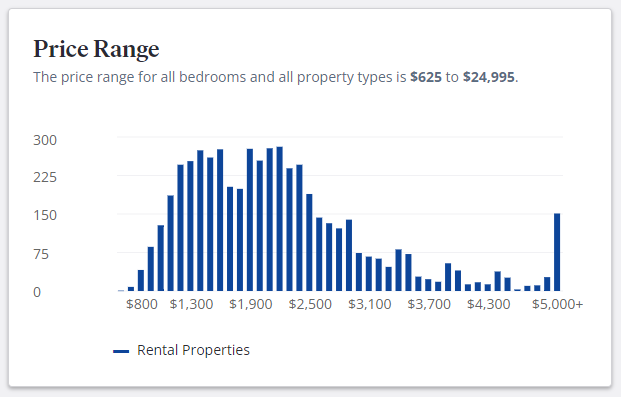

1. High Rental Returns

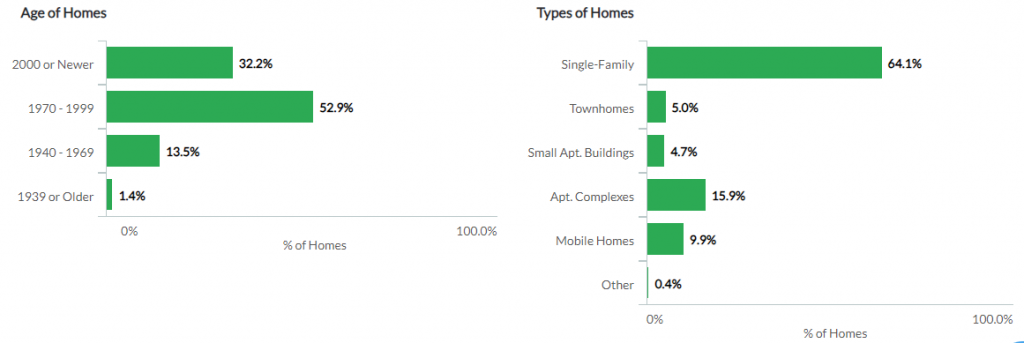

Arizona’s housing market has over 900,000 rental households, accounting for 36% of total households. Rental prices in Arizona have increased, with a Fair Market Rent (FMR) of $1,097 for a two-bedroom apartment. The average rent paid by Arizona tenants in 2023 is $1,553.

Source: Zillow

Rental rates are expected to have little to no change as interest rates rise. With the housing shortage remaining an issue, rental rates could continue to climb. Arizona will likely remain attractive for investors targeting rental returns over short-term appreciation.

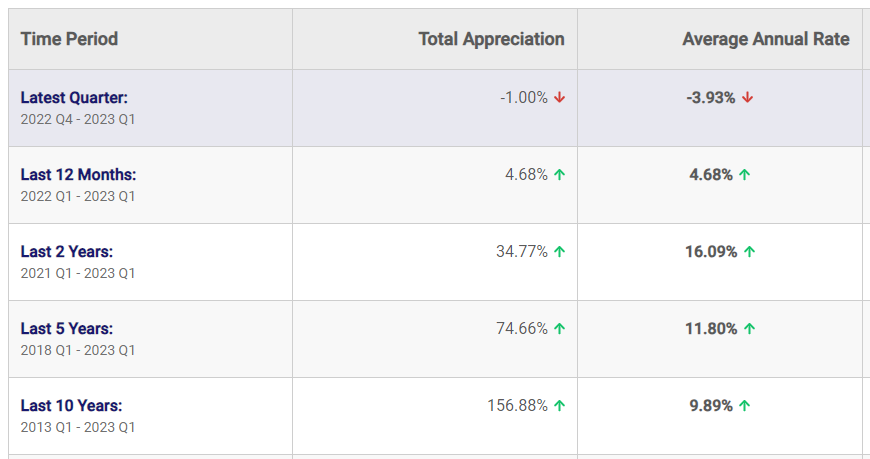

2. Real estate appreciation rate over the last 10 years

Zillow reports a 54.2% increase in the median sale price over the past two years and an incredible 93.2% increase over the past five years.

Source: Neighbourhoodscout

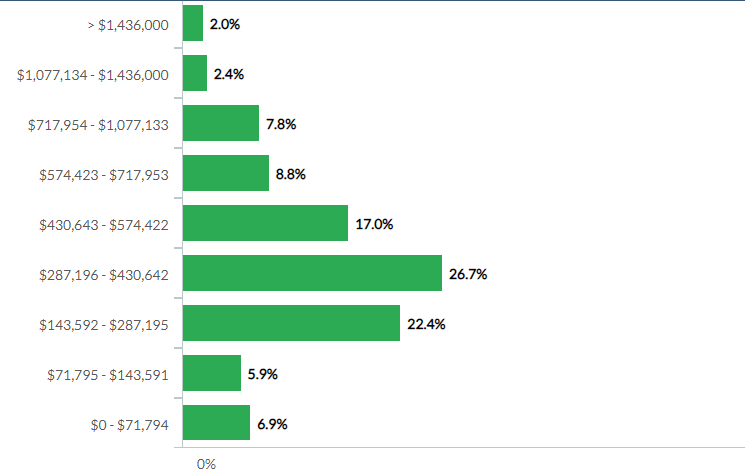

3. Real Estate Affordability

In May 2023, the median sales price for all housing types in Arizona was $350,390, a 3.2% decrease from the previous year, according to the Arizona Association of Realtors. This report shows a trend of Arizona home prices stabilizing. Following is a graph of the home prices of Arizona property.

Source: Neighbourhoodscout

Source: Redfin

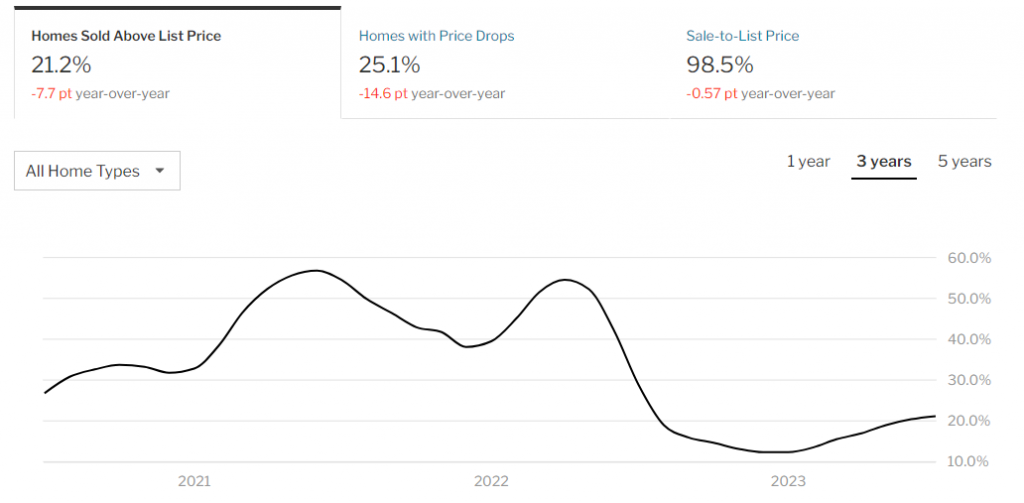

4. 98.3% sale-to-list price ratio

According to Zillow, the median days pending on the site in May 2023 were just 24 days, indicating increased property purchases. This not only shows a vibrant market but also suggests that investing in Arizona real estate can be an excellent decision from a resale value perspective.

Furthermore, the sale-to-list price ratio was 98.3%, suggesting sellers often achieved close to their asking price at closing. While list prices can vary by region, the AZ real estate market offers diversity. Nearly 60% of homes sold below the list price in April 2023, providing opportunities for buyers to negotiate.

Source: Redfin

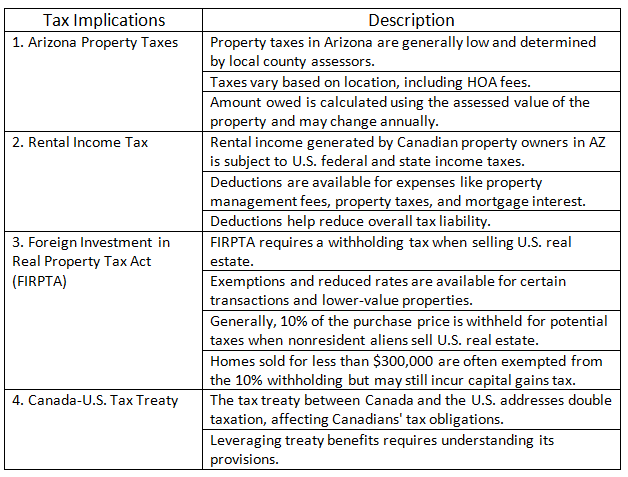

Tax Implications of Buying a Property in Arizona

Canadians recognize Arizona’s real estate investment potential due to tax benefits, as no extra tax is levied on Canadians for buying property in America. Moreover, Arizona’s attractive features, like low property taxes and no state income tax, make it an ideal investment destination for portfolio diversification.

Seek guidance from cross-border tax professionals and attorneys as they provide professional services and help minimize tax liabilities. Additionally, rental income taxation can be influenced by the Canada-U.S. tax treaty, potentially reducing or eliminating withholding tax for Canadians.

Conclusion

In conclusion, there are many reasons to buy property in Arizona, and with this complete guide, you can do it easily.

To make the home-buying process easier, HomeAbroad can connect you with mortgage lenders and real estate agents who specialize in working with foreign nationals. These professionals with international expertise will guide you through the process and make your purchase hassle-free!

Find the best real estate agent and mortgage lender with international expertise.

Connect with a local international real estate agent and mortgage lender

FAQs

1. Are Canadians allowed to purchase property in the U.S.?

Yes, Canadians are allowed to purchase property in the USA. There are generally no restrictions on Canadians buying real estate in the U.S.

2. Where do Canadians buy a second home?

Canadian second-home buyers have a range of popular destinations to choose from, including Florida, Arizona, California, and Hawaii.

3. Can Canadians buy property in Arizona?

Absolutely, Canadians can buy property in Arizona, just like they can in other U.S. states. Arizona is a popular destination for Canadian buyers.

4. Do Canadians pay tax when purchasing U.S. Real Estate?

Yes, Canadians may be subject to certain taxes when purchasing U.S. real estate. These taxes can include property taxes, income taxes on rental income or capital gains, and withholding taxes. Tax implications vary based on individual circumstances, so you should contact tax professionals for a better understanding.

5. Can Canadians get a U.S. Mortgage?

Yes, Canadians can obtain a mortgage in the U.S. However, requirements may vary among lenders. HomeAbroad can help you contact lenders specializing in cross-border transactions to facilitate the mortgage process.

6. Are there any restrictions for Canadians purchasing homes in Arizona?

There are generally no specific restrictions for Canadians purchasing homes in Arizona. However, it’s essential to know tax implications, visa and immigration requirements, and other applicable regulations.

7. Where is the best place to buy property in Arizona?

The best place to buy property in AZ depends on individual preferences and goals. Popular areas for Canadian buyers in Arizona include the Phoenix metro area, Scottsdale, Tucson, and Sedona. Consider factors like lifestyle, amenities, climate, and investment potential when choosing a location.

8. Are there any specific considerations or resources for Canadians buying property in Arizona?

You should consider factors like cross-border taxation, currency exchange, and international financing options. Resources such as legal advisors, tax professionals, and real estate agents experienced in cross-border transactions can provide valuable guidance.

9. What are the common property types available for a Canadian buyer in Arizona?

Canadians can find various property types in AZ, including single-family homes, condos, townhouses, and vacation properties. The choice depends on your preferences and investment goals.

"Unlocking US real estate for the world with our tailored offerings."

How Does HomeAbroad Help?